GST Registration

Schedule a Callback

Enter your details and we’ll call you shortly.

GST Registration

GST is a term used for Goods and Services Tax, it is an indirect tax that has eliminated many indirect taxes. The Goods and Service Tax came into effect on 1st July 2017.

Structure of GST

- CGST-Central Goods and Service Tax

- SGST- State Goods and Service Tax

- IGST-Integrated Goods and Service Tax

Types of GST Registration

- Compulsory Registration

GST being a tax on the event of “supply”, Every Supplier needs to get registered except businesses having all India aggregate turnover below 40 lakh (20 lakh for the North East States and UT, Telangana and Puducherry) and 20 lakhs (in case of a supply of services or in case of missed supplies) (10 lakh for North East State and UT, Telangana and Puducherry).

- Voluntary Registration

A business that doesnot fall under the ambit of compulsory registration can apply for registration on voluntary basis.

- Registration under Composite Scheme

A registered taxable person, whose aggregate turnover does not exceed Rs. One crore (Rs. 75 lakhs for special category States except for J & K and Uttrakhand) in any financial year, may opt for this scheme

Common Questions

Frequently Asked Questions

GST means Goods and Services Tax. It is a unique identification number allotted to a business entity for paying the applicable taxes on the goods sold and services delivered by it or goods bought and services hired by this entity.

To apply online for GST certificate, please visit the official website, you are required to fill in your details, including PAN card number and Bank details. You are also asked to upload your documents such as UID number, address proof etc. After the verification of these documents, a unique GST number is issued and the GST certificate is emailed to the applicant.

You are required to visit the official Government website, you will get the option of new GST application, modify earlier application or cancel the GST certificate issued earlier.

The documents required for GST Registration are as following:

- Id and Address Proof of Proprietor/Directors/s

- Proof of Business address/Rent Agreement

- Photograph of Proprietor/Directors/s

- Certificate of Incorporation (CIN) if the applicant is a company

- Board Resolution if an applicant is a company

- Bank Account details

There is no Government fee for GST Registration and the applicant does not need to spend any money for GST registration, though any private individual/entity hired for GST Registration Certificate may charge a nominal amount.

After the complete application is filed, it may take 20-30 days for the issuance of GST certificate.

Quick Enquiry

Get in Touch

Call Us

+91-8076272381

Mon–Fri: 9:00 AM – 6:00 PM

Email Us

info@metacorp.in

We respond within 24 hours

Visit Us

2nd Floor, C-60, Sec-63,

Noida UP-201301

Business Hours

Request a Consultation

Latest Articles

What is Non-Ferrous Metals Extended Producer Responsibi...

By Team Metacorp • Feb 24, 2026

What is Non-Ferrous Metals Extended Producer Responsibility (EPR) Framework?

Read More

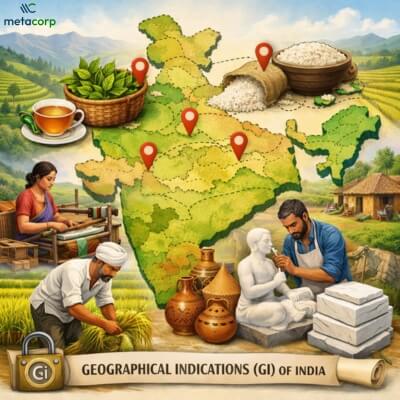

What is Geographical Indication of Goods (GI) ?

By Team Metacorp • Jan 21, 2026

Understanding what is Geographical Indication of Goods (GI) ? How it is important for the businesses

Read More

How Proper Hazardous Waste Management Protects Your Bus...

By Team Metacorp • Jan 15, 2026

Proper Hazardous Waste Management helps businesses stay legally compliant, avoid penalties, and reduce the ris...

Read More